Access the latest news and updates from 888 Holdings Plc and its brands.

17 Mar 2022

Our racing ambassador Nick Luck gives his thoughts on Day 3 of the greatest show on turf

16 Mar 2022

Our racing ambassador Nick Luck gives his thoughts on Day 2 of the greatest show on turf

15 Mar 2022

Our racing ambassador Nick Luck gives his thoughts on Day 1 of the greatest show on turf

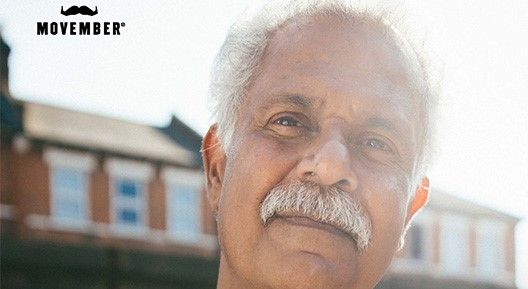

08 Jan 2020

888 launches advertising campaign to raise awareness of potentially problematic gambling